18+ Mortgage on 100000

With a 100000 salary you have a shot at a great homebuying budget. Rates are based on individual credit score and LTV.

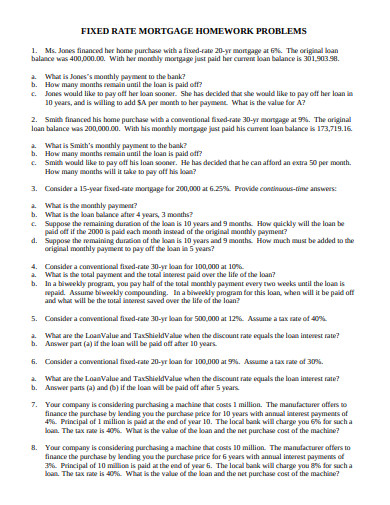

11 Fixed Rate Mortgage Template In Doc Pdf Free Premium Templates

The Best Jumbo Mortgage Rates for 2022.

. In other words using that same 100000 line we had above if you used 45000 to pay off an existing lien and for your closing costs you would have 55000 left on your line. Whether buying a primary residence or a real estate investment property 2022 could be the year to resume your housing searchWith the end of the pandemic on the horizon price surges and inventory shortages should begin to stabilize this year. Assuming a 3 annual inflation rate the 100000 loan balance would only be worth about 74000 in 10 years.

30 Year Fixed 1. Substantial interest penalties required for early withdrawal on CDs. The maximum rate on the Adj.

September 18 2018 Loan-to-value ratio for mortgage. APR disclosed is for A credit and may not be applicable to all. Acquisition debt comes from using a reverse mortgage to buy a house or refinancing debt that was acquisition debt.

Which wiped out approximately 100000 people in London alone during an 18-month period. On a 100000 mortgage with an interest rate of 3 your monthly payment for principal and interest is 421 per month. Coupled with the dramatic increase of permanent remote work opportunities new locations are primed to be.

Some conventional lenders will accept down payments as low as 3 but youll most likely need to purchase private mortgage insurance PMI to secure the loan. That 100000 wont actually be worth 100000 in future dollars. In this detailed guide of Nevadas inheritance laws we break down intestate succession probate what makes a will valid and moreIf youd like professional guidance with your estate plan or just need help investing your inheritance you can use SmartAssets free financial advisor matching tool.

Conforming. Most closed mortgage products allow a once-per-year lump sum payment of up to 20 of the remaining principal amount or balance. The limits on deductions for acquisition debt are far higher than for home equity debt.

View todays reverse mortgage interest rates APR read our 3 tips to help decide which interest rate is best for you. 2 The limit on home equity interest deduction is not 100000 of interest but rather the interest on 100000 of home equity debt. Rate Interest Only HELOC is 1800.

That the going 30. USDA Home Loans. With a zero down payment Equity Builder.

Higher Recasting Payment Lower Monthly Payment Lenders may recast your loan with 5000 while others may require up to 10000. Call 806378-8280 for current market rates. Once you have 100K saved saving the next 100000 is a lot easier.

And here is the best part. 618 718 APR. So for a 100000 mortgage youd need a down payment of 20000 excluding closing costs and taxes.

While you are working to increase your savings more your original 100000 is growing all by itself thanks to interest. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. All rates are subject to change daily.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Mortgage rates stem back to the days of ancient Rome and still hold sway today. If your balance at the end of the year is 100000 the maximum lump sum payment for that year would be 20000.

Begin your house hunting journey. Buying Younger Means Paying Less for a 100000 Life Insurance Policy. Rate Interest Only HELOC is 550.

100 Financing And Very Low Mortgage Rates April 18. Ideally try to pay a higher sum to decrease. For a 1 million home youre likely to need a minimum of 100000 to 200000 saved for that purpose.

Early Mortgage Payoff Calculator. The longer you delay buying a policy the higher the rates will go. Age is a key rating factor for life insurance companies.

The minimum rate on the Adj. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Then one day you will realize you saved 100000.

Using a future inflation calculator we can get an idea of what that original mortgage balance will actually be worth in say 10 or 15 years. On a 30-year jumbo mortgage the average rate is 5. Nevada does not charge estate or inheritance taxes.

This is thanks to compounding.

Mlrqcshywedacm

15 Online Loan Applications Personal Auto Home 2022 Badcredit Org

7 Cash Advance Loans With No Credit Check In 2022 Badcredit Org

How Much Is Pmi Insurance Private Mortgage Insurance Pmi Insurance Mortgage

Pin By Victoria Martinez On 101 Goals Life Vision Board Dreams Do Come True Positive Thoughts

One Third Of Mortgage Borrowers Would Struggle If Interest Rates Rise Mortgage Rates The Guardian

Free 9 Sample Balloon Loan Calculator Templates In Pdf

Win 60 000 Mortgage Free For A Year Itv Comps

8 Loan Application Form Templates Word Pages Google Docs Pdf Free Premium Templates

Bitcoin Price Will Rise To 100 000 Expert Predictions Money

100k Savings Tracker Instant Downloadprintable Savings Etsy Savings Tracker Money Saving Strategies Money Saving Plan

12 Bad Credit Loans With Preapproval 2022 Badcredit Org

Gov T Considers 100 000 Cash Handout For Children Aged 18 Or Younger Japan Today

Nowofloan Membership Card Membership Card Cards Personal Loans

Mortgage Introducer July 2022 By Key Media Issuu

16 Best Interest Rates For Bad Credit 2022 Badcredit Org

19 Mortgage Website Themes Templates Free Premium Templates