Total leverage calculator

Leverage Your Home Equity Today Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options. That cost which do not change with the change in the level of production.

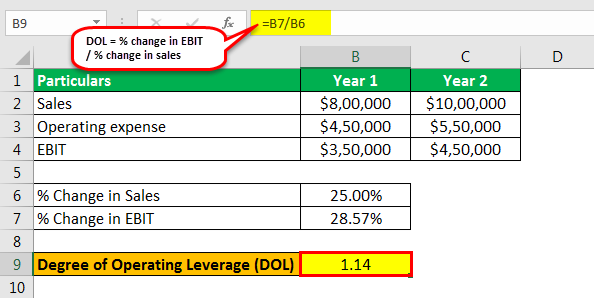

Operating Leverage Formula Calculator Example With Excel Template

Similar to the case before the extra information of the advanced section is.

. For instance when the price of assets in an account rises trading on margin allows investors to use leverage to increase their gains. Firstly determine the cost of production which is fixed in nature ie. Total Cost 20000 6 3000.

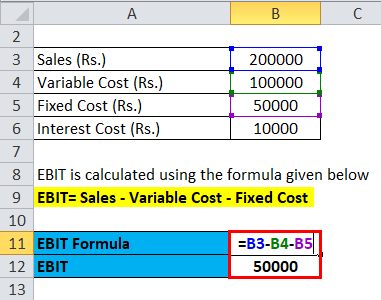

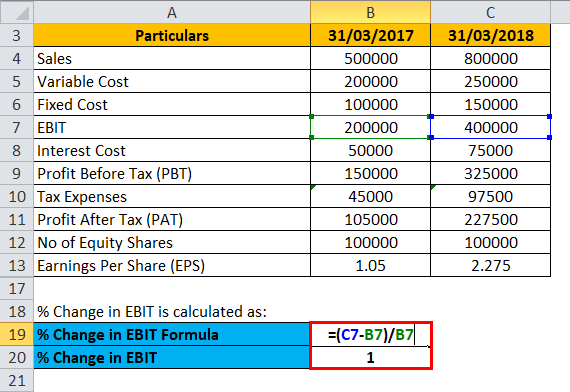

Cash out debt consolidation options available. Revenue for year 2018 100907 Revenue for year 2017 73585 Revenue Formula Example 3. EBIT during the current and previous years.

From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. Calculate the profit margin of making trading products or doing business in general. The formula for total cost can be derived by using the following five steps.

Loan Balance 15 Years. And by using our Expense Ratio Calculator we get. Currency pair - the currency youre trading.

In other words it is the ratio between total net open positions to total margin on your deposit. Some examples of the fixed cost of production are selling expense rent expense. Here total sales are equal to total revenue of a company.

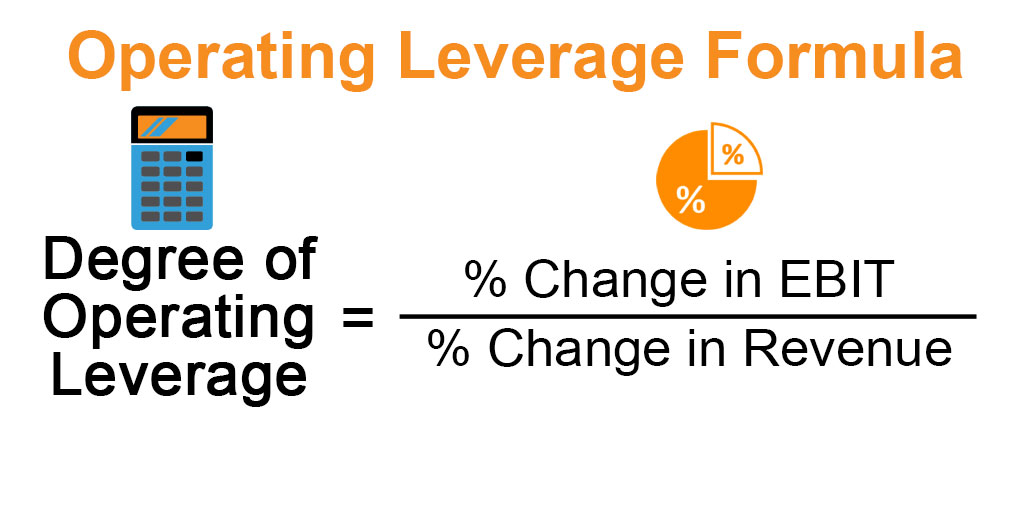

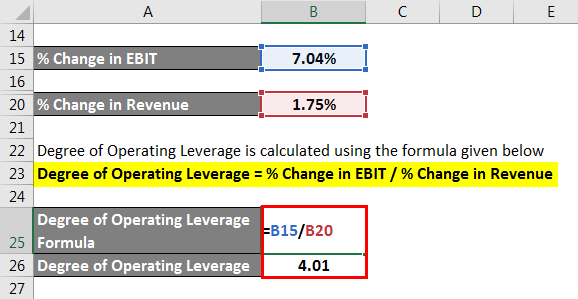

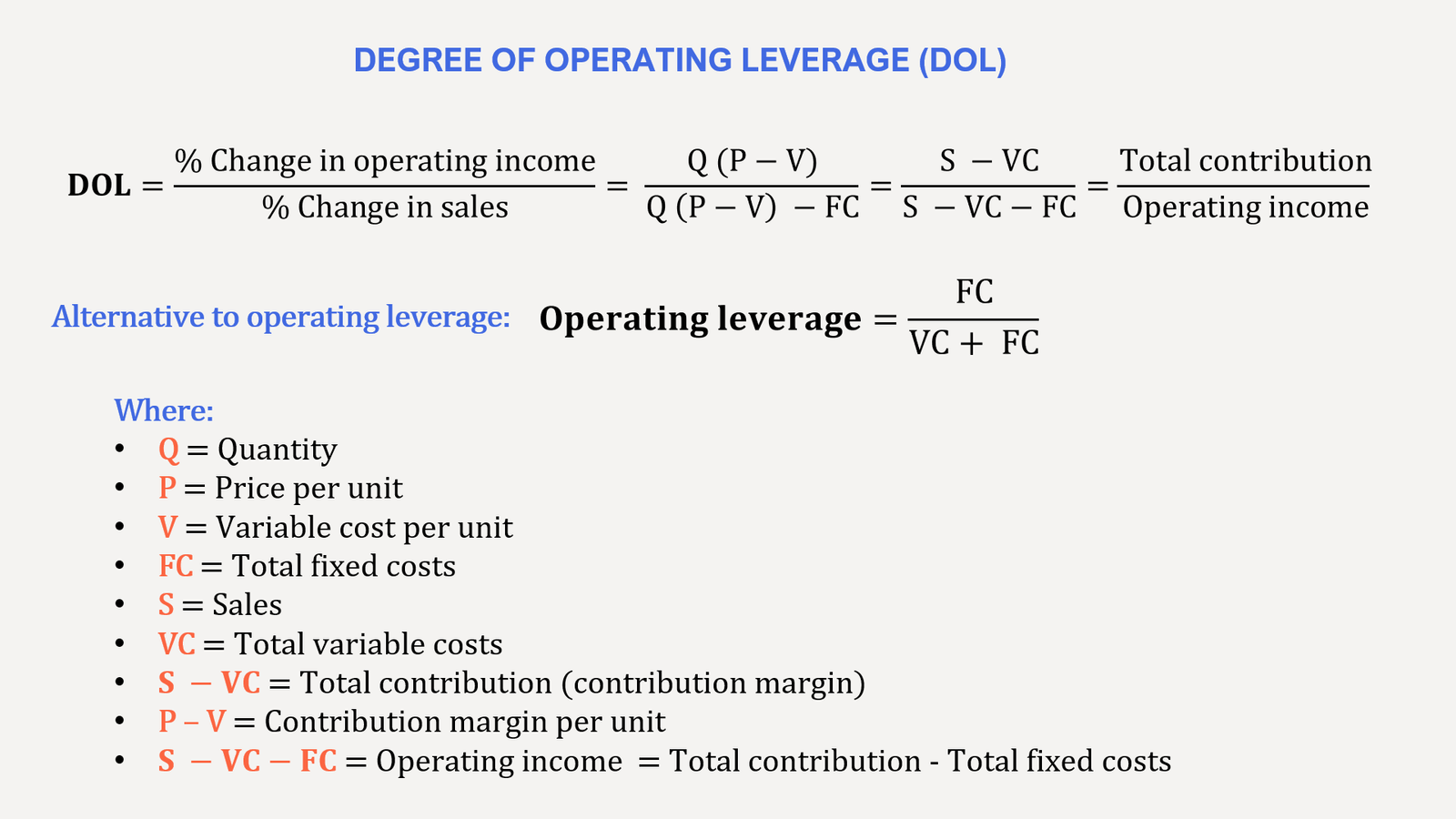

The degree of operating leverage calculator is an investing tool that provides you with a ratio that explains how much earnings can be influenced by a change in sales. A bakery sells 35 cookies packet per day at the price of 20 per pack to increase the sale of cookies owner did analysis and find that if he decreases the price of cookies by 5 his sale will increase by 5 packets of. Equity Built 15 Years.

Loan Balance 5 Years. A leverage ratio calculation is complex however with our forex leverage calculator you just need to input a few values and calculate it easily. Now compute the percentage change in EBIT initially by deducting the EBIT of the previous year from that of the current year and then dividing the result by the EBIT of the previous year as shown below.

This calculator figures monthly home payments for 15-year loan terms. The formula can be derived by using the following three steps. Firstly determine the operating income vs.

Total Cost 38000 Explanation. However when the prices of these assets fall the loss in value is much. Loan Balance 10 Years.

Total cost of ETF 20766 USD.

Operating Leverage Formula And Calculator Excel Template

Financial Leverage Formula Calculator Excel Template

Operating Leverage Formula And Calculator Excel Template

Operating Leverage Formula Calculator Example With Excel Template

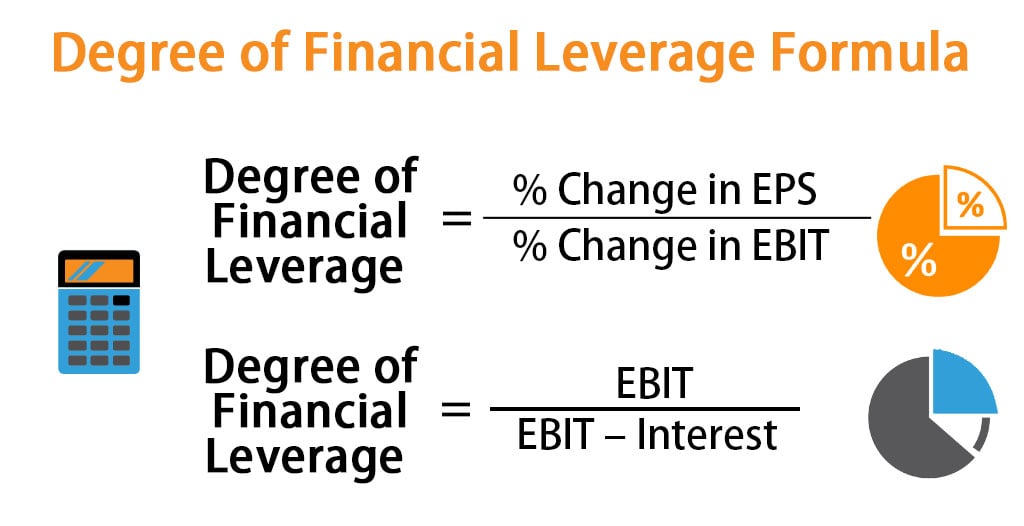

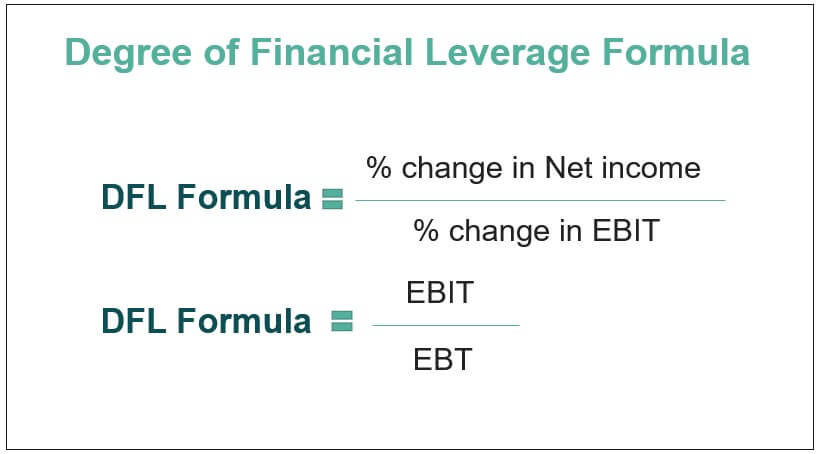

Degree Of Financial Leverage Formula Calculator Excel Template

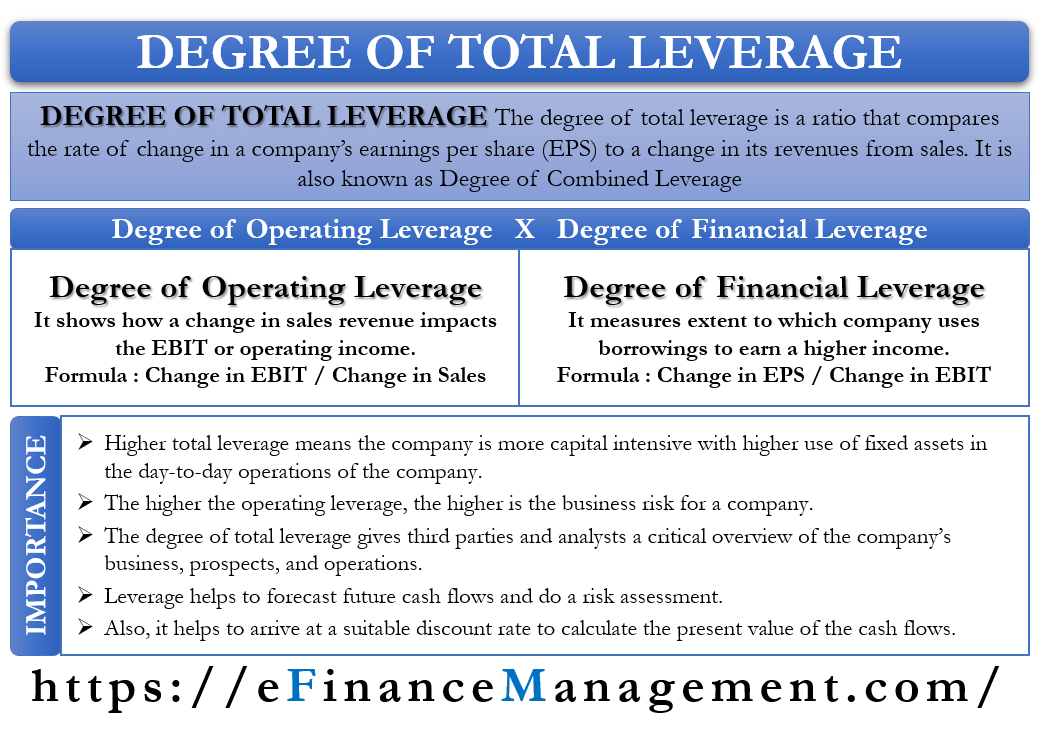

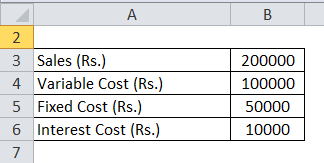

Degree Of Total Leverage Dtl Formula And Calculator Excel Template

Degree Of Total Leverage Meaning Calculation Importance Interpretation

Degree Of Financial Leverage Formula Step By Step Calculation

Operating Leverage Ratio Analysis Double Entry Bookkeeping

Financial Leverage Formula Calculator Excel Template

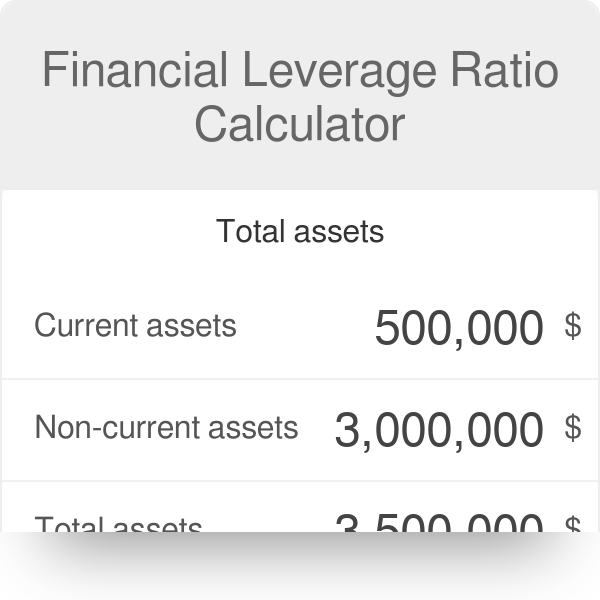

Financial Leverage Ratio Calculator Formula

Operating Leverage Formula And Calculator Excel Template

Financial Leverage Formula Calculator Excel Template

Degree Of Operating Leverage Formula Calculation Examples

Operating Leverage Why It Matters How To Calculate It Penpoin

Financial Leverage Formula Calculator Excel Template

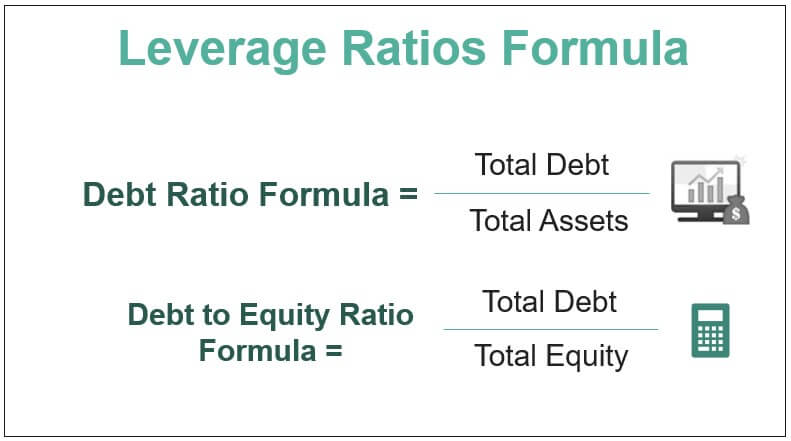

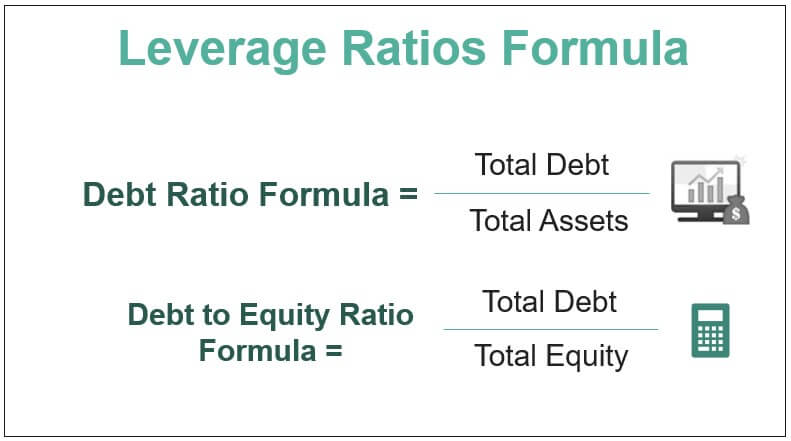

Leverage Ratios Formula Step By Step Calculation With Examples